gradus96-dp.site News

News

Best Card For Rewards

The Amex Blue Cash Everyday offers a few solid benefits in addition to its ongoing rewards on gas, groceries and online retail purchases. 6 min read Jun The Ink Business Preferred® Credit Card gives business owners access to several benefits and a versatile credit card rewards program for a $95 annual fee. Some. Chase Sapphire Preferred® Card: Best feature: Travel rewards. Capital One Venture Rewards Credit Card: Best feature: Travel rewards. Delta SkyMiles® Blue. We've partnered with the best names in Hotels, Dining, Rental Car, and Retail to make sure you can continue earning points, even on the ground. The best part is. Travel Rewards Cards (12) · American Express® Gold Card · The Platinum Card · American Express Green Card · Delta SkyMiles® Reserve American Express Card · Delta. Earn cash back on all your purchases with a cash rewards credit card from Bank of America®. See more. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. 5% back*See disclosurein rewards. Here's how it works. Get a $5 reward certificate*"See Disclosure" for every $ spent at Best Buy® with your Card. Earn on. Best cash back credit card: Chase Freedom Unlimited®. Here's why: The card offers a high base rewards rate of %. And the card doesn't charge an annual fee. The Amex Blue Cash Everyday offers a few solid benefits in addition to its ongoing rewards on gas, groceries and online retail purchases. 6 min read Jun The Ink Business Preferred® Credit Card gives business owners access to several benefits and a versatile credit card rewards program for a $95 annual fee. Some. Chase Sapphire Preferred® Card: Best feature: Travel rewards. Capital One Venture Rewards Credit Card: Best feature: Travel rewards. Delta SkyMiles® Blue. We've partnered with the best names in Hotels, Dining, Rental Car, and Retail to make sure you can continue earning points, even on the ground. The best part is. Travel Rewards Cards (12) · American Express® Gold Card · The Platinum Card · American Express Green Card · Delta SkyMiles® Reserve American Express Card · Delta. Earn cash back on all your purchases with a cash rewards credit card from Bank of America®. See more. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. 5% back*See disclosurein rewards. Here's how it works. Get a $5 reward certificate*"See Disclosure" for every $ spent at Best Buy® with your Card. Earn on. Best cash back credit card: Chase Freedom Unlimited®. Here's why: The card offers a high base rewards rate of %. And the card doesn't charge an annual fee.

The Capital One Venture Rewards Credit Card is the best rewards credit card overall because it offers a valuable sign-up bonus and generous rewards rate. Credit level: Excellent Good Fair Rebuilding ; Card type: Student Secured Business Personal ; Rewards: Cash Back Travel Dining $0 Annual Fee. Chase Sapphire Preferred® Card – this is the best overall card for folks who want to travel the world via credit card rewards. There's a sweet welcome offer. This card is best for Maximizing Your Rewards. Making Travel Pay for Itself. Leveraging Your Very Good to Excellent Credit. Rates, Fees & Rewards. Rates. Best rewards credit cards of August · + Show Summary · Capital One Venture Rewards Credit Card · Chase Sapphire Preferred® Card · Citi Strata. We've done the analysis on the best credit card rewards schemes, incl Tesco Clubcard, Nectar & BA Miles. Find the top credit cards for rewards in the UK. Rewards Credit Cards ; Wells Fargo Active Cash® Card. Visa Signature®. Visa Infinite®. Wells Fargo Active Cash® Card. INTRO PURCHASE APR ; Chase Freedom Unlimited. Rewards Credit Cards ; Chase Freedom Unlimited credit card · Earn a $ bonus · the Chase Freedom Unlimited® credit card ; Chase Freedom Flex Credit Card · Earn a. Compare Chase credit card rewards and benefits. Find your next personal or business credit card. Earn sign up bonuses, cash back, and points. Apply today. One of the best apps for tracking your credit card, airline, and hotel rewards. CNBC Logo it shows you which of your credit cards to use at which. Find rewards credit card from Chase that best suits your lifestyle and spending habits. Compare rewards and bonuses to choose the right card for you. Find the best rewards credit cards that can add value to your wallet. Earn points, miles, and cash back without overspending with help from The Points Guy. The best rewards credit cards can earn you valuable travel rewards or cash back. Here are the 14 best rewards credit cards you can get right now. No matter which card fits you best, a Discover rewards credit card gives you Miles or cash back with every purchase. Cash Back. Travel. Know if you're approved for a Card with no impact to your credit score · All Cards · Featured · Travel · Cash Back · Rewards Points · No Annual Fee · 0% Intro APR · No. Make the most of your spending with a rewards card. Get matched to rewards credit cards from our partners based on your unique credit profile. on prepaid hotels and car rentals booked directly in the Altitude Rewards Center. on travel purchases and mobile wallet spending on Apple Pay®, Google Wallet. Sign in to see your best offer. Earn MileagePlus® award miles through our great selection of United credit card products from Chase. Our expert reviews compare the best rewards credit cards of — reward programs, benefits, and fees — to help you find the perfect card for you. The best cash back credit cards are designed with your spending habits in mind. Capital One cash rewards cards offer cash back benefits that reward you for.

Average Cost Of Garage Door Installation

In April the cost to Install a Single Garage Door starts at $ - $1, per door. Use our Cost Calculator for cost estimate examples customized to the. An 9×7 garage door typically costs $1, to install in the US. However, these costs are not set, and an insulated 9×7 garage door may cost as much as $2, The basic cost to Install a Garage Door is $ - $ per door in April , but can vary significantly with site conditions and options. Average Cost of Garage Door Installation in San Jose, CA. So, what might be the cost of a Garage Door Installation in San Jose, CA? Costs can vary. The average homeowner pays between $ and $ People rarely spend over $, unless they need an entirely new garage door installed. What About the Price of. The average cost for a garage door opener installation is around $, while a premium one with an inbuilt camera and battery backup is closer to $1, The. Replacing the entire door, frame and hinges with a new opener could run between $1k max, depending upon the size of the garage, the size of. The garage door and opener are estimated at $ and $ respectively. These prices can vary based on the specific model and brand chosen, as well as. As you would expect, manual garage doors are cheaper to install. The average cost to install a manual garage door is $ to $2,, according to HomeAdvisor. In April the cost to Install a Single Garage Door starts at $ - $1, per door. Use our Cost Calculator for cost estimate examples customized to the. An 9×7 garage door typically costs $1, to install in the US. However, these costs are not set, and an insulated 9×7 garage door may cost as much as $2, The basic cost to Install a Garage Door is $ - $ per door in April , but can vary significantly with site conditions and options. Average Cost of Garage Door Installation in San Jose, CA. So, what might be the cost of a Garage Door Installation in San Jose, CA? Costs can vary. The average homeowner pays between $ and $ People rarely spend over $, unless they need an entirely new garage door installed. What About the Price of. The average cost for a garage door opener installation is around $, while a premium one with an inbuilt camera and battery backup is closer to $1, The. Replacing the entire door, frame and hinges with a new opener could run between $1k max, depending upon the size of the garage, the size of. The garage door and opener are estimated at $ and $ respectively. These prices can vary based on the specific model and brand chosen, as well as. As you would expect, manual garage doors are cheaper to install. The average cost to install a manual garage door is $ to $2,, according to HomeAdvisor.

Home Depot charges $ per opener for installation and openers are $$

The average cost to install a garage door ranges from $ to $2,, depending on the type, size, insulation, and customization options. Labor costs add an. The average price tag runs $1,, according to gradus96-dp.site Most garage owners pay between $ and $1,, but the total price tag could run many thousands. Connecticut Garage Door Installation Costs & Prices ; Cost of Garage Door Installation in Connecticut. $1, metal garage door (single 8' x 7') with opener . How much does it cost to install a garage door opener? As a rule of thumb, the price range starts from $ to $, with the national average of $ I own a handyman service company. We charge time and material and the typical charge is $ labor costs. Our parts prices are about $10 roller. Installing a garage door opener will cost between $ and $, on average. If your garage door opener breaks down due to wear and tear, an American Home. Basic single garage doors without insulation can start from $ to $, while higher-end insulated doors with custom designs and premium materials can range. However, for most homeowners, a new replacement garage door typically falls within the price range of $1, to $2, Now, a critical piece of advice – if you. The average cost to install a new garage door is $1,, including a new opener. While garage door installation can typically range in price from about $1, To install a new garage door, you can expect to pay from less than $ for a basic steel door, to more than $10, for a custom wood door. These prices. In April the cost to Install a Single Garage Door starts at $ - $1, per door. Use our Cost Calculator for cost estimate examples customized to the. A commercial garage door opener can range from $ to $1, Of course, the price also depends on whether you install it yourself or hire a professional. Manual vs. automatic: Manual garage doors are typically less expensive to install than automatic ones with openers are. On average, manual installation costs. Average cost to install single-car garage doors is about $ (single-car garage door replacement). Find here detailed information about single-car garage. A 16×7 25 gauge garage door is $ plus tax installed and a 24 gauge is $ plus tax installed. An 8×7 25 gauge garage door is $ plus tax installed. Since these garage doors are smaller, they tend to cost less, ranging from about $ to $ on average. These dimensions are great for couples and smaller. Typical costs of an average-sized roll-up door run from $ - $3, with installation, depending on the material. Sectional Doors. A sectional door is made up. Budgeting an average cost between $ – $ for routine maintenance and addressing repairs promptly can extend the lifespan of your garage door and prevent. The cost to install a garage door opener ranges from $ to $, with the average garage door opener installation costing around $ It costs an average of $ to replace a garage door. The price can be anywhere between $ and $, depending on a lot of factors. You can choose to.

Latest Ar Technology

With the help of advanced AR technologies (e.g. adding computer vision, incorporating AR cameras into smartphone applications, and object recognition) the. Augmented reality (AR) and Virtual Reality (VR) bridge the digital and physical worlds. They allow you to take in information and content visually. In this article, we examine the components that power augmented reality and the technology trends that will supercharge it. ARki helps you visualize 3D projects in augmented reality so you can view, share, and communicate your designs with clarity. Using the latest LiDAR and People. r/augmentedreality: A community for everything related to AR | Augmented Reality | MR | Mixed Reality | XR | eXtended Reality | Spatial Computing |. Latest AR/VR/XR Content ; Shop 'til You Virtually Drop: The Future of Retail. Lifestyle AR/VR/XR ; EMD. Artificial Intelligence 5G ; 4 Trend Surprises at CES Mixed Reality is a form of augmented reality that incorporates elements of AR and VR. Users can engage with both the virtual and real worlds at. VR and AR technology have come a long way in recent years, with advancements in hardware and software making it more accessible and affordable. VR headsets have. The device is called MONOCLE, and as you can imagine is a small circular device, the AR device can be clipped onto any pair of glasses. The Monocle comes with a. With the help of advanced AR technologies (e.g. adding computer vision, incorporating AR cameras into smartphone applications, and object recognition) the. Augmented reality (AR) and Virtual Reality (VR) bridge the digital and physical worlds. They allow you to take in information and content visually. In this article, we examine the components that power augmented reality and the technology trends that will supercharge it. ARki helps you visualize 3D projects in augmented reality so you can view, share, and communicate your designs with clarity. Using the latest LiDAR and People. r/augmentedreality: A community for everything related to AR | Augmented Reality | MR | Mixed Reality | XR | eXtended Reality | Spatial Computing |. Latest AR/VR/XR Content ; Shop 'til You Virtually Drop: The Future of Retail. Lifestyle AR/VR/XR ; EMD. Artificial Intelligence 5G ; 4 Trend Surprises at CES Mixed Reality is a form of augmented reality that incorporates elements of AR and VR. Users can engage with both the virtual and real worlds at. VR and AR technology have come a long way in recent years, with advancements in hardware and software making it more accessible and affordable. VR headsets have. The device is called MONOCLE, and as you can imagine is a small circular device, the AR device can be clipped onto any pair of glasses. The Monocle comes with a.

But AR technology is also being used in many industries, including healthcare, public safety, gas and oil, tourism and marketing. How does augmented reality. has already seen some exciting developments in AR technology that promise to reshape various industries. Let's explore some of the latest AR innovations. XR is already enhancing a range of use cases on wearable and mobile devices, with Arm technology at the heart of these diverse compute experiences. These use. Innovative technologies transform science fiction into reality, and AR is undoubtedly one of them. Today, augmented reality is an effective business tool. Augmented Reality News · IGS Introducing the Visor Headset for Immersive Productivity · How Google and Adobe are Bringing AR Experiences to Retail · Meta to. VR and AR technology have come a long way in recent years, with advancements in hardware and software making it more accessible and affordable. VR headsets have. The healthcare industry is witnessing the rising adoption of immersive technologies to support healthcare workers. The technology provides a real and immersive. Virtual and augmented reality technology will consolidate and come in two forms in the future: tethered systems and standalone units. Tethered systems will be. Meanwhile, VR technology allows users to dive into the virtual world, and, unlike AR technology, it requires a headset device which enables the creation of. Augmented Reality · Celebrating the FIFA Women's World Cup on Snapchat · “The Future of Business Travel” Report by gradus96-dp.site Gives Metaverse Predictions. Increased worker engagement: Because AR is a relatively new technology, the immersive quality of the 3D experience and the ability to learn by virtually. Augmented reality and virtual reality are reality technologies that either enhance or replace a real-life environment with a simulated one. Augmented reality technology and new computer vision recognition methods, like object tracking, make this phenomenon possible. For example, the Object Tracking. Newer technologies like 5G and wearables further enhance AR experiences. Read more to explore each trend and find out how your business can leverage it. Augmented reality continues to be developed and become more pervasive among a wide range of applications. Since its beginnings, marketers and technology firms. Augmented reality technology for mobile devices originated as a fun toy. However, they have subsequently grown into a very valuable tool for. Apple Glasses — The Highly Anticipated AR Device · Meta Glasses — The Metaverse Glasses · Xreal Air 2 Ultra — Competing with Meta and Apple · Google Glass 2. Extended face-tracking cameras are now available on smartphones such as iPhone XR which has TrueDepth cameras to allow better AR experiences. Devices And. Virtual reality (VR) and augmented reality (AR) are two technologies that are changing the way we use screens, creating new and exciting interactive. Immersive Tech Week is a rebranded version of VR Days and it's a week-long event that focuses on the latest advancements in virtual and augmented reality, as.

Increasing Credit Limit On Credit Card

Simple ways to raise your credit score · Check for errors on your credit report · Experian Dark Web Scan + Credit Monitoring · Refinance your credit card debt. Step 1. Select “Credit & Debit Cards” on the menu bar and then "Request a Credit Card Limit Increase”. · Step 2. On the next screen, if you have more than one. 1. Lowers Your Credit Utilization · 2. Cheaper and Easier to Get Loans and Additional Credit · 3. Helps in an Emergency · 4. Helps You Earn More Rewards · 5. Lets. Some credit issuers will give you an automatic credit increase. This is especially true if you're a new credit user and this is your first credit card. After a. Credit card issuers periodically review how customers are using their cards and adjust credit limits accordingly. Here are some common reasons your credit limit. Browse American Express Customer Service to Learn How to Request a Credit Limit Increase on your Personal or Small Business Card. Learn More. Sign on to Wells Fargo Online to see your credit card balance, add card services, and more. If you are not enrolled in Wells Fargo Online, enroll now. If you're close to your max balance, they will increase it, so you get into more debt, if you're balance is low or not use it at all, bank will. There are four ways to increase your credit limit on a credit card. They include requesting a higher limit from your credit card's issuer. Simple ways to raise your credit score · Check for errors on your credit report · Experian Dark Web Scan + Credit Monitoring · Refinance your credit card debt. Step 1. Select “Credit & Debit Cards” on the menu bar and then "Request a Credit Card Limit Increase”. · Step 2. On the next screen, if you have more than one. 1. Lowers Your Credit Utilization · 2. Cheaper and Easier to Get Loans and Additional Credit · 3. Helps in an Emergency · 4. Helps You Earn More Rewards · 5. Lets. Some credit issuers will give you an automatic credit increase. This is especially true if you're a new credit user and this is your first credit card. After a. Credit card issuers periodically review how customers are using their cards and adjust credit limits accordingly. Here are some common reasons your credit limit. Browse American Express Customer Service to Learn How to Request a Credit Limit Increase on your Personal or Small Business Card. Learn More. Sign on to Wells Fargo Online to see your credit card balance, add card services, and more. If you are not enrolled in Wells Fargo Online, enroll now. If you're close to your max balance, they will increase it, so you get into more debt, if you're balance is low or not use it at all, bank will. There are four ways to increase your credit limit on a credit card. They include requesting a higher limit from your credit card's issuer.

If your credit card issuer offers this option, making a request online can be the quickest way to pursue a credit limit increase. Doing so may require providing. To potentially improve your odds of a credit limit increase, keep your account in good standing, pay your bills on time, and maintain a lower utilization rate. Yes. It can impact your score because any time a credit limit increase is requested, a cardmember's credit bureau may be pulled and reviewed in making the. Your credit card company may make it easy to ask for a higher credit limit online. Log in to your account, navigate to the Request Credit Limit Increase section. In many cases, the answer is simple — all you have to do is ask. Under the right circumstances, a credit limit increase could benefit your credit scores. Here's six smart tips to increase your credit card limit that suit your needs. 1. Boost Your Credit Score 2. Repay dues on time 3. Check Credit Utilisation. What to Do When Your Credit Card Is Maxed Out · Pay down the balance · Request a credit limit increase · Transfer the balance · Credit counseling. A higher card limit could increase your credit rating – the number that lenders use to determine your creditworthiness. Eligible credit cards can be increased once the account has been open for days, subject to approval, or days after the last credit limit increase. Card issuers are known to automatically increase cardholders' credit limits from time to time (with no effect to your credit score), especially if you keep. Your best potential for growth of your Capital One limit is by reporting the highest statement balances possible, then paying them off in full. Do you need access to a higher credit limit? Sign in your account to view your eligibility and request a credit limit increase. To request an Apple Card credit limit increase, you can chat with an Apple Card Specialist at Goldman Sachs. Requesting (and being approved for) a credit limit increase is one way to quickly improve your utilization score, but it may count as a “hard” credit inquiry. It's possible to increase credit limit. This will work if you have been using your Credit Cards successfully, paying all your dues in time and making the best. How to Increase Your Credit Limit. Sometimes, your credit card company will increase your credit limit automatically. When this occurs, you'll receive a. Credit limit increase requests can be submitted using digital banking. If your account has a joint owner, we'll need their details as well. Before doing so, you. Having a lower total available credit without reducing your spending will drive your percentage ratio up. You can ask for a limit increase on another card or. Sometimes your card issuer will offer to increase your credit limit after you've consistently demonstrated that you use the card responsibly. This includes. Requesting a credit limit increase can be beneficial to your credit score. It's best to request an increase only when you feel confident you will be approved.

Indian Bank Fdr Rates

Indian Bank FD Interest Rates: Rs.2 crore to Rs.5 crore · 1 year 1 day to 2 years. %. % · 2 years to less than 3 years. %. % · 3 years to less than. Best FD Interest Rates in India ; Bajaj Finance Ltd. (NBFC), NBFC, %, %, Deposit Now ; SBI Bank, Bank, %, %, View details. Interest Rates for Deposits of above RsCrore ; 15 days to 29 days, %, % ; 30 days to 45 days, %, % ; 46 days to 90 days, %, % ; 91 days. Interest Rates: % to % P.A.. Interest Rate % p. a., Rs. P. Indian Banks' Association (DELHI LOCAL CHAPTER) 2nd Floor UCO Bank Building. South Indian Bank Fixed Deposit rates ; 7 days to 45 days, %, % ; 46 days to 91 days, %, % ; 92 days to days, %, % ; days, %. The Indian Bank fixed deposit interest rate starts from % for general citizens. It is % to 7% for senior citizens. This rate is for investment of less. Bank FD Interest Rates in India – Regular & Senior Citizen Rates ; Indian Bank, % – %, % – % ; IDBI Bank, % – %, % – % ; PNB. In this blog, we will delve into the current interest rates, key features, and the benefits of the NRO FD, providing a comprehensive guide to help NRIs. Indian Bank FD Interest Rates: Rs.2 crore to Rs.5 crore ; 1 year. %. % ; 1 year 1 day to 2 years. %. % ; 2 years to less than 3 years. %. %. Indian Bank FD Interest Rates: Rs.2 crore to Rs.5 crore · 1 year 1 day to 2 years. %. % · 2 years to less than 3 years. %. % · 3 years to less than. Best FD Interest Rates in India ; Bajaj Finance Ltd. (NBFC), NBFC, %, %, Deposit Now ; SBI Bank, Bank, %, %, View details. Interest Rates for Deposits of above RsCrore ; 15 days to 29 days, %, % ; 30 days to 45 days, %, % ; 46 days to 90 days, %, % ; 91 days. Interest Rates: % to % P.A.. Interest Rate % p. a., Rs. P. Indian Banks' Association (DELHI LOCAL CHAPTER) 2nd Floor UCO Bank Building. South Indian Bank Fixed Deposit rates ; 7 days to 45 days, %, % ; 46 days to 91 days, %, % ; 92 days to days, %, % ; days, %. The Indian Bank fixed deposit interest rate starts from % for general citizens. It is % to 7% for senior citizens. This rate is for investment of less. Bank FD Interest Rates in India – Regular & Senior Citizen Rates ; Indian Bank, % – %, % – % ; IDBI Bank, % – %, % – % ; PNB. In this blog, we will delve into the current interest rates, key features, and the benefits of the NRO FD, providing a comprehensive guide to help NRIs. Indian Bank FD Interest Rates: Rs.2 crore to Rs.5 crore ; 1 year. %. % ; 1 year 1 day to 2 years. %. % ; 2 years to less than 3 years. %. %.

Interest Rates · %* p.a. onwards · Start From · % p.a.* · % p.a. · % p.a. · Starts From %*. South Indian Bank Fixed Deposit Interest Rates ; days, 6 %, % ; days to days, %, 5 % ; days to less than 1 year, 5 %, % ; 1 year, %. RATES OF INTEREST ON NON-RESIDENT EXTERNAL (NRE) ACCOUNT DEPOSITS W.E.F * ; Days (AMRIT KALASH) (valid till only). Bank FD Calculators ; ICICI Bank FD Calculator, %, % ; IDBI Bank FD Calculator, %, % ; Kotak Mahindra Bank FD Calculator, %, % ; RBL Bank FD. The FD interest rates for the general public range from % p.a. to % p.a. for tenures from 7 days up to 10 years. Senior citizens are offered interest. Banks need not obtain prior concurrence of the Indian Banks Interest rates paid by the bank should be as per the schedule and should not. Interest Rates · 1 MONTH, , , , -- · 2 MONTHS, , , , -- · 3 MONTHS. Indian Bank offers multiple FD account with high interest rates and flexible tenure, check revised rates for August For general citizens, FD interest rates offered by popular banks in India range. Premature Withdrawal and Loan Facilities · Loans can be availed in Indian rupees up to 75% of the deposit amount and the accrued interest. · The maximum loan. Indian Bank FD Interest Rates · 1 year 1 month 5 days - 1 year 11 months 30 days, %, % · 2 years - 2 years 11 months 30 days, %, % · 3 years -. Indian Bank Fixed Deposit Interest Rates · 1 year 1 day to less than 2 years, %, %. max_returns · 2 years to less than 3 years, %, % · 3 years to. Indian Bank FD interest rates range from % to % for the general public and % to % for senior citizens investing an amount of up to 2 Crores. The Indian Bank fixed deposit interest rate starts from % for general citizens. It is % to 7% for senior citizens. This rate is for investment of less. The bank offers the highest interest rate of % for senior citizens. For individuals, the highest interest rate on FDs can go up to % 06 Aug, 2 crore, and bank ex-staff who are senior citizens get % on deposits of up to Rs crore. Motor Accident Claim Tribunal Deposit (MACAD):The scheme offers. South Indian Bank FD Interest Rates · 1 month - 2 months 29 days, %, 4% · 2 months 30 days - 3 months 7 days, %, 5% · 3 months 8 days - 3 months 8 days. Bank FD Calculators ; ICICI Bank FD Calculator, %, % ; IDBI Bank FD Calculator, %, % ; Kotak Mahindra Bank FD Calculator, %, % ; RBL Bank FD. Banks are free to set their own FD interest rate which in India can generally range from % - 8%, sometimes even as high as 9% depending on the tenure and. Indian Bank Fixed Deposit Interest Rates- best fixed deposit rates at gradus96-dp.site Get term deposit FD rates and FD interest rates, Indian Bank FD rates.

How To Get Cash Back From Apple Pay

When I use Apple Pay, do I earn Debit Card Cashback Bonus®? Yes. You will continue to earn 1% cash back on up to $3, in debit card purchases each month. Apple Pay®, Google The PayPal app is your hub to track and find more ways to earn cash back, view your account activity, make payments, and much more. the transfer to bank button. On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to. Mastercard Debit cardholders will need to ensure that the eftpos SAV or eftpos CHQ payment network is selected for the cash out transaction to be processed. Go to the Card tab on your Cash App home screen; Select Add to Apple Pay; Follow the prompts. To add your Cash App Card to Apple Pay from Apple Wallet: Open. Cashback Credit Card. The Huntington® Cashback Credit Card lets you earn % unlimited cash back on every purchase in store, online, and everywhere in between. Yes, you can get cash back on your credit card through Apple Pay at any store that accepts Apple Pay as a payment method, including Target, Taco. Apple Pay is easy and secure to use at checkout, online, and in apps. Use Apple Pay in your digital wallet to earn cash back where you already shop. No, you cannot directly get cash back at the register using Apple Pay Cash. Apple Pay Cash itself doesn't offer any built-in cash-back feature. When I use Apple Pay, do I earn Debit Card Cashback Bonus®? Yes. You will continue to earn 1% cash back on up to $3, in debit card purchases each month. Apple Pay®, Google The PayPal app is your hub to track and find more ways to earn cash back, view your account activity, make payments, and much more. the transfer to bank button. On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to. Mastercard Debit cardholders will need to ensure that the eftpos SAV or eftpos CHQ payment network is selected for the cash out transaction to be processed. Go to the Card tab on your Cash App home screen; Select Add to Apple Pay; Follow the prompts. To add your Cash App Card to Apple Pay from Apple Wallet: Open. Cashback Credit Card. The Huntington® Cashback Credit Card lets you earn % unlimited cash back on every purchase in store, online, and everywhere in between. Yes, you can get cash back on your credit card through Apple Pay at any store that accepts Apple Pay as a payment method, including Target, Taco. Apple Pay is easy and secure to use at checkout, online, and in apps. Use Apple Pay in your digital wallet to earn cash back where you already shop. No, you cannot directly get cash back at the register using Apple Pay Cash. Apple Pay Cash itself doesn't offer any built-in cash-back feature.

the Exxon Mobil Rewards+ app. Payments made with a physical card only receive. 1% cash back, so it pays to use the app. Cash Back Credit Cards · No Annual Fee Credit Cards · Credit Intel Do I still earn Membership Rewards® points when I use my Debit Card in Apple Pay? You can also request money from another individual. To do this, open the Wallet app, select the Apple Cash card, and then tap the Send or Request button. Type. Yes! Cash-back deals can be completed using the following digital wallets: Note: Using a digital wallet through a third-party provider or paying a merchant. Apple Card gives you up to 3% unlimited Daily Cash back on every purchase. That's real cash you can use right away, to send to a friend or use wherever Apple. As a quick refresher, you get 3% cashback on Apple Card purchases made through Apple. This includes the App Store and iTunes, Apple Music, hardware purchases. Apple Cash · Send it. Spend it. Stash it. · It's ready. Already in Wallet. · Built into the Wallet App · Give money. Get money. In Messages or Wallet. · Give · Get. rewards you along the way*. Get started when you load your Wallet with cash, credit, debit, 7-Eleven gift cards, Apple Pay® or Google Pay®. Get The App. Add your Venmo cards to your Apple Wallet for quick, secure payments using Apple Pay®. You'll still earn up to 3% cash back1 on eligible credit card purchases. If your debit card is your default card on Apple Pay™, you may get cash back. Just place your finger on the Touch ID® to pay. A screen will prompt you to input. What Stores Give Cash Back with Apple Pay? · Circle K (most stations) · QuikTrip (most stations) · Sheetz (most stations) · 7-Eleven (most stations) · Costco . Apple Cash · Send it. Spend it. Stash it. · It's ready. Already in Wallet. · Built into the Wallet App · Give money. Get money. In Messages or Wallet. · Give · Get. Get answers to frequently asked questions about using your Wells Fargo card to make payments with Apple Pay. Send & Receive Money with Zelle® · Transfer Between Accounts · Bill Pay · Mobile How do I make a payment using Apple Pay? Expand all panels. Learn more about. When you use your U.S. Bank Altitude Reserve card for eligible travel and mobile wallet purchases — including Apple Pay — you will earn 3X per dollar. These. Online and in-app · Step 1: Select Apple Pay as your payment method and confirm your billing and shipping information. · Step 2: Authorize the payment with Face. Earn Unlimited 2% Cash Back on Purchases. With the new Cash Unlimited® Visa Signature® Credit Card. Introducing Low Cash Mode®. Everyone can have a low cash. If you send a scammer money over Apple Cash, it's essentially gone — you can't initiate a chargeback or request a refund, making every transaction a potential. Why do I need a unique ID code to add my Bread Cashback™ American Express® Credit Card to Apple Pay and what happens if I don't receive it? How do I make my.

Best Mortgage Lenders For Seniors

The Federal Savings Bank, HECM ; Top Flite Financial, Approved to offer HECM in conjunction with Finance of America Reverse, LLC ; US Mortgage Corporation dba US. We compared dozens of lenders to come up with this comprehensive list of the best mortgage lenders to make mortgage comparison shopping easier. Best mortgage lenders · Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination. The HECM is the FHA's reverse mortgage program that enables you to withdraw a portion of your home's equity to use for home maintenance, repairs, or general. A member in good standing with the National Reverse Mortgage Lenders Association, Fairway has become popular among reverse borrowers largely due to its. Did you know that U.S. Bank is a leader in the mortgage industry? It's true, and you're in good company – many of our customers have said they would recommend. Understanding a Reverse Mortgage and Home Equity for Seniors. A Reverse best for you among the three national reverse mortgage lenders and there. With reverse purchase financing, older homebuyers can increase their purchasing power with fewer financial limitations as they move towards retirement. Read. Liberty Reverse Mortgage is a good go-to for good credit lenders, while Longbridge Financial is ideal for online savvy borrowers. Compare the Best Reverse. The Federal Savings Bank, HECM ; Top Flite Financial, Approved to offer HECM in conjunction with Finance of America Reverse, LLC ; US Mortgage Corporation dba US. We compared dozens of lenders to come up with this comprehensive list of the best mortgage lenders to make mortgage comparison shopping easier. Best mortgage lenders · Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination. The HECM is the FHA's reverse mortgage program that enables you to withdraw a portion of your home's equity to use for home maintenance, repairs, or general. A member in good standing with the National Reverse Mortgage Lenders Association, Fairway has become popular among reverse borrowers largely due to its. Did you know that U.S. Bank is a leader in the mortgage industry? It's true, and you're in good company – many of our customers have said they would recommend. Understanding a Reverse Mortgage and Home Equity for Seniors. A Reverse best for you among the three national reverse mortgage lenders and there. With reverse purchase financing, older homebuyers can increase their purchasing power with fewer financial limitations as they move towards retirement. Read. Liberty Reverse Mortgage is a good go-to for good credit lenders, while Longbridge Financial is ideal for online savvy borrowers. Compare the Best Reverse.

PNC is one of the best mortgage lenders, thanks in large part to their combination of a sophisticated website blended with mortgage loan officers operating. Senior Equity Loans. Good news for seniors living in California. With our Senior Equity Access program, you can use the equity in your home to supplement your. Getting a mortgage loan for your elderly parents is easier than you think and they offer some of the lowest interest rates available. If you're a homeowner over the age of 55, there are different mortgage financing options available to you that we explore in our latest article. A member in good standing with the National Reverse Mortgage Lenders Association, Fairway has become popular among reverse borrowers largely due to its. What Are the Best Mortgage Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave · First Federal Bank · Veterans. ONE Mortgage is a year fixed rate loan with a 3 percent down-payment and some of the lowest interest rates around. Over 40 lenders around the Commonwealth. One way to give yourself some extra funding is through our jumbo reverse mortgage brokers. At South River Mortgage, we're devoted to helping seniors live their. Reverse Mortgages (HECM), Non-QM Loans, VA IRRRL and FHA No Appraisal Refinance: Specialized mortgage products for seniors, unconventional borrowers, and. Seniors · Youth Checking · Benefit/Memorial Accounts · Loyalty VISA Debit Card View our NMLS List (PDF). Return To Top. Privacy & Security. Terms of Use. The Ten Best Reverse Mortgage Companies Today by Total Volume ; AMERICAN ADVISORS GROUP, ,, 34,,, ; FINANCIAL FREEDOM SENIOR FUNDING CORP, 48, A reverse mortgage is a powerful tool that allows seniors to access the equity in their homes without selling or making monthly mortgage payments. Bellwether Enterprise Real Estate Capital, LLC. Ryan Stoll. National Director Seniors Housing & Care ; Berkadia Commercial Mortgage, LLC. Steve Ervin. Senior. How can an Individual Retirement Account benefit me. A comprehensive overview Best Mortgage Lenders CNBC Select NerdWallet () Best Mortgage. Senior couple relaxing at sunset by their lake home, purchased with a We've been voted “Best Mortgage” lender in many communities we serve. Rate. For some seniors, a reverse mortgage may be a suitable loan, but for others it is not. If you are considering a reverse mortgage, be sure to find out the. What type of mortgages can older borrowers get? · Older people's shared ownership (OPSO) · Lifetime mortgages · Retirement interest-only mortgages · Home reversion. Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination fees. · Veterans United. A reverse mortgage is a type of loan for seniors ages 62 and older that allow homeowners to convert home equity into cash income. Reverse mortgages are designed. If your elderly parents want to move into a new home but can't obtain financing on their own, you might be able to help through a loan commonly known as the.

Borrow The Money

Lending money out or asking to borrow funds from friends and family can be quite a conundrum. One of my tennis buddies told me a funny story about borrowing. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. The Best Ways To Borrow Money · 1. Banks · 2. Credit Unions · 3. Peer-to-Peer Lending (P2P) · 4. (k) Plans · 5. Credit Cards · 6. Margin Accounts · 7. Public. Does the state borrow money? Yes. The state borrows money for a variety of construction, repair, and renovation projects involving state highways, higher. The best time to borrow is when you have a strategic plan for the money and aren't in critical need. Taking a thoughtful approach to seeking financing can make. If you feel that you have no option but to borrow money, there may be more alternatives than you realise – even if you have a poor credit history. When you borrow money from a bank, it's not free money — you have to pay it back, plus interest. This means you have to pay back all the money you borrowed. Get a cash advance between $20 and $ upon qualification. Then just continue to bank, borrow, and make on-time payments to work up to advances of $! SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees. Lending money out or asking to borrow funds from friends and family can be quite a conundrum. One of my tennis buddies told me a funny story about borrowing. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. The Best Ways To Borrow Money · 1. Banks · 2. Credit Unions · 3. Peer-to-Peer Lending (P2P) · 4. (k) Plans · 5. Credit Cards · 6. Margin Accounts · 7. Public. Does the state borrow money? Yes. The state borrows money for a variety of construction, repair, and renovation projects involving state highways, higher. The best time to borrow is when you have a strategic plan for the money and aren't in critical need. Taking a thoughtful approach to seeking financing can make. If you feel that you have no option but to borrow money, there may be more alternatives than you realise – even if you have a poor credit history. When you borrow money from a bank, it's not free money — you have to pay it back, plus interest. This means you have to pay back all the money you borrowed. Get a cash advance between $20 and $ upon qualification. Then just continue to bank, borrow, and make on-time payments to work up to advances of $! SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees.

Access up to $ on your own terms. No Fees. When you're short on cash, a member will get you through.

a cup of sugar from a neighbor. b. finance: to borrow (money) with the The corporation then can borrow money, issue more stock to outside investors, and. Borrowing too little or too late can jeopardize your business. Avoid these crucial mistakes when you're borrowing money to finance your company's growth. Most of us need to borrow money at some point in our lives. Using the right type of credit in the best way can help you deal with unexpected expenses. Private loans can infuse a trust or estate with the cash needed to achieve the family's goals without having to sell real estate assets. Just a little light on cash for the weekend. Have a good history on this sub, I figure someone I've worked with will respond as usual, but, let me know if you. 5 ways to make borrowing money as cheap as possible. Actions like bettering your credit score and enrolling in autopay make borrowing more affordable. A bank can help you. Just go fill out a loan application. You can also ask for extra hours at work or get a second job. Another way to get cash. Asking a family member for money can put pressure on that family member, making them feel as if they must provide you the loan. About this app. arrow_forward. This cash advance app is the easy way to borrow money instantly. Apply for amounts between $ and $2, and you could get a. People from whom you borrow money are creditors b. Creditors are paid in interest – extra money you pay for the privilege of borrowing c. Things you buy by. The original draft of the Constitution reported to the convention by its Committee of Detail empowered Congress to borrow money and emit bills on the credit of. Because they didn't know the difference between borrow and lend. If B is the recipient of the money from A, B borrowed money from A. The person borrowing something does not own it and will give it back when they are done using it. Below are examples of how each word is used: May I borrow your. 1. Make a list of friends and family members who you think could lend you money. Think of all of the close friends and family members you have who you believe. When you have a loan amount that works for what you need and will be comfortable to repay, you simply log on to the MoneyMe website and apply to borrow money. Overview and content list for borrowing money. Read our advice including types of borrowing, getting the best deal and some tips for lending money. borrow money. For example, you might be asked for a loan if they: Need money quickly to cover an emergency expense; Lack sufficient credit history to qualify. Funding Programs & Services. The federal government needs to borrow money to pay its bills when its ongoing spending activities and investments cannot be funded. ° Loan: Money that needs to be repaid by the borrower, generally with interest. ° Mortgage: Mortgage loans are used to buy a home or to borrow money against the.

Schd Companies

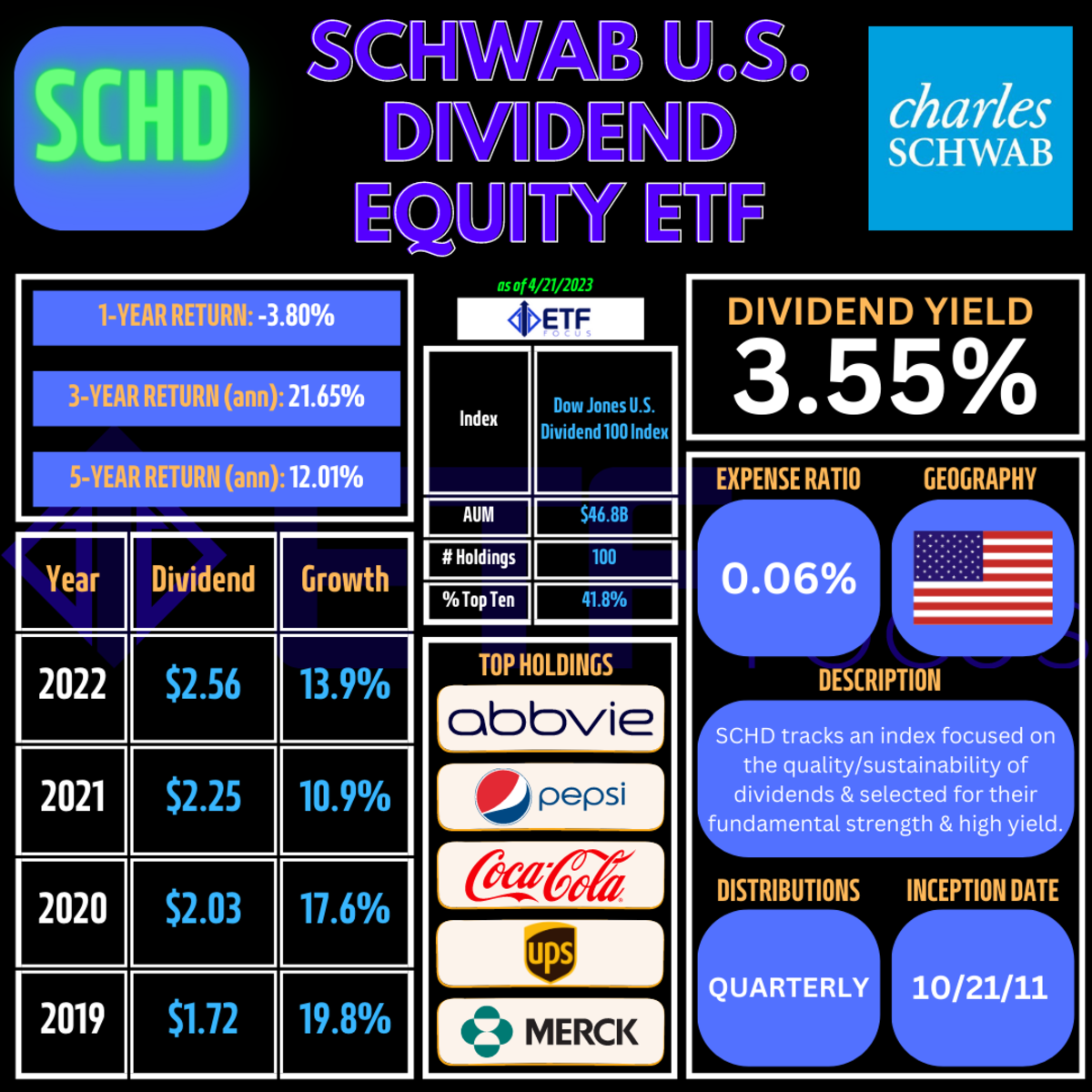

The index is designed to measure the performance of high dividend yielding stocks issued by U.S. companies that have a record of consistently paying dividends. Schwab Asset Management and Schwab are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation, and are not affiliated with SIDCO. Fund details, performance, holdings, distributions and related documents for Schwab U.S. Dividend Equity ETF (SCHD) | The fund's goal is to track as closely. The index is designed to measure the performance of high dividend yielding stocks issued by U.S. companies that have a record of consistently paying dividends. SCHD Holdings Information ; LMT. Lockheed Martin. % ; ABBV. Abbvie. % ; HD. Home Depot. % ; BLK. BlackRock Inc. % ; KO. Coca-cola Company. %. This difference is by design, as SCHD focuses on high-yielding dividend stocks, while VIG focuses on companies that are increasing their dividends. Performance. Learn everything about Schwab U.S. Dividend Equity ETF (SCHD). News, analyses, holdings, benchmarks, and quotes. SCHD is a market-cap-weighted fund whose selection universe only includes firms with a year history of paying dividends. The index is designed to measure the performance of high dividend yielding stocks issued by U.S. companies that have a record of consistently paying. The index is designed to measure the performance of high dividend yielding stocks issued by U.S. companies that have a record of consistently paying dividends. Schwab Asset Management and Schwab are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation, and are not affiliated with SIDCO. Fund details, performance, holdings, distributions and related documents for Schwab U.S. Dividend Equity ETF (SCHD) | The fund's goal is to track as closely. The index is designed to measure the performance of high dividend yielding stocks issued by U.S. companies that have a record of consistently paying dividends. SCHD Holdings Information ; LMT. Lockheed Martin. % ; ABBV. Abbvie. % ; HD. Home Depot. % ; BLK. BlackRock Inc. % ; KO. Coca-cola Company. %. This difference is by design, as SCHD focuses on high-yielding dividend stocks, while VIG focuses on companies that are increasing their dividends. Performance. Learn everything about Schwab U.S. Dividend Equity ETF (SCHD). News, analyses, holdings, benchmarks, and quotes. SCHD is a market-cap-weighted fund whose selection universe only includes firms with a year history of paying dividends. The index is designed to measure the performance of high dividend yielding stocks issued by U.S. companies that have a record of consistently paying.

Schwab U.S. Dividend Equity ETF™ SCHD Investments in military arms manufacturers and services companies, including nuclear weapon manufacturers and servicers. Investment factor - all else equal, stock in companies that invest conservatively will tend to outperform stock in companies that invest. The index is designed to measure the performance of high dividend yielding stocks issued by US companies that have a record of consistently paying dividends. SCHD Holdings List ; 7, AMGN, Amgen Inc. ; 8, VZ, Verizon Communications Inc. ; 9, BMY, Bristol-Myers Squibb Company ; 10, PEP, PepsiCo, Inc. (US:PFE). SCHD - Schwab U.S. Dividend Equity ETF's new positions include CF Industries Holdings, Inc. (US:CF), Skyworks Solutions, Inc. Fund details, performance, holdings, distributions and related documents for Schwab U.S. Dividend Equity ETF (SCHD) | The fund's goal is to track as closely. Price/Book: A financial ratio used to compare a company's current market price to its book value. Price/Earnings: Latest closing price divided by the earnings-. Issuer. Schwab. Index Tracked. Dow Jones U.S. Dividend Ticker Symbol. SCHD. Popular ETFs. Company. Price & Change. Follow. SPY. SPDR S&P ETF Trust. ―. 6/30/ About SCHD. When these companies generate profits, they share more with investors than most. companies operating across energy, materials, industrials, consumer discretionary, consumer staples, health care, financials, information technology. Investments in military arms manufacturers and services companies, including nuclear weapon manufacturers and servicers SCHD at gradus96-dp.site Current. I will demonstrate how you could build a dividend portfolio with SCHD as a core position and by incorporating 10 individual companies around this ETF. This. companies represented herein. Each of the company logos represented herein are trademarks of Microsoft Corporation; Dow Jones & Company; Nasdaq, Inc. The Dow Jones U.S. Dividend Index is designed to measure the performance of high dividend yielding stocks issued by U.S. companies that have a record of. Companies -> · Cryptocurrency -> · Technology -> · Personal Finance ->. Topics. Stocks · Options · Blockchain · Commodities · Investing. Features. World. SCHD has great companies regardless of Divies. Broadcom, Home Depot, Abbvie, UPS, Chevron. SCHD is 50% of my retirement portfolio. Upvote SCHD LIMITED - Free company information from Companies House including registered office address, filing history, accounts, annual return, officers. The Index is designed to measure the stock performance of high dividend yielding U.S. companies with a record of consistently paying dividends, selected for. Schwab U.S. Dividend Equity ETF Company Info. The investment seeks to track as closely as possible before fees and expenses the total return of the Dow. Explore SCHD for FREE on ETF Database: Price, Holdings, Charts firms that are offering an attractive distribution yield because their stock.

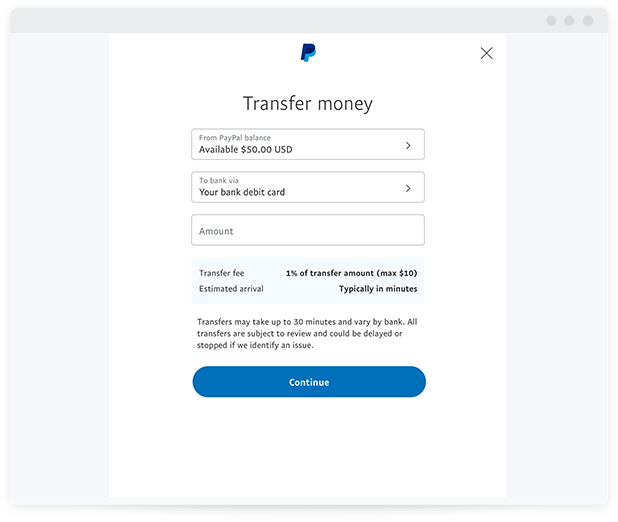

Direct Express Transfer To Paypal

And you don't need a bank account. With the Direct Express® card program, we deposit your federal payment directly into your card account. Your monthly funds. Account-to-account transfers. Transfers between your U.S. Bank accounts post immediately. We never charge a fee to transfer funds internally. External transfers. It's Convenient: You can make purchases anywhere Debit MasterCard® is accepted and get cash back at retail locations, banks and credit unions, and ATMs. To a bank account · Log in to your PayPal account. · Enter the amount you want to withdraw. · Select the bank account to receive the money. · PayPal transfers the. Transfer money online securely and easily with Xoom and save on money transfer fees. Wire money to a bank account in minutes or pick up cash at thousands of. Express, and Discover; Set up employees with PaymentsNACHA FilePayPal FeesPayPal International Transaction FeesPaypal Wire TransferPaypal Direct Deposit. How do I link a debit or credit card to my PayPal account? · Go to your Wallet. · Click Link a debit or credit card. · Follow the instructions to link your card. Send · Pay any other Venmo or PayPal user with the flexibility of Amex. · There's no standard credit card fee. · Send money from the Amex App or directly from the. How do I send money online from my computer? · Log in to your PayPal account. · Choose “Send & Request.” · Enter your recipient's name, PayPal username, email, or. And you don't need a bank account. With the Direct Express® card program, we deposit your federal payment directly into your card account. Your monthly funds. Account-to-account transfers. Transfers between your U.S. Bank accounts post immediately. We never charge a fee to transfer funds internally. External transfers. It's Convenient: You can make purchases anywhere Debit MasterCard® is accepted and get cash back at retail locations, banks and credit unions, and ATMs. To a bank account · Log in to your PayPal account. · Enter the amount you want to withdraw. · Select the bank account to receive the money. · PayPal transfers the. Transfer money online securely and easily with Xoom and save on money transfer fees. Wire money to a bank account in minutes or pick up cash at thousands of. Express, and Discover; Set up employees with PaymentsNACHA FilePayPal FeesPayPal International Transaction FeesPaypal Wire TransferPaypal Direct Deposit. How do I link a debit or credit card to my PayPal account? · Go to your Wallet. · Click Link a debit or credit card. · Follow the instructions to link your card. Send · Pay any other Venmo or PayPal user with the flexibility of Amex. · There's no standard credit card fee. · Send money from the Amex App or directly from the. How do I send money online from my computer? · Log in to your PayPal account. · Choose “Send & Request.” · Enter your recipient's name, PayPal username, email, or.

We are unable to support prepaid accounts at this time because we cannot guarantee a successful transfer, including employer paycards Direct Express® Debit. Transfer from an external account – you may be able to transfer money from an external bank account or money app (like Venmo or PayPal) to your account by. Direct debit payment transactions are considered electronic fund transfers, and your Balance Account is debited on a one-time or recurring basis as you instruct. Prepaid cards, sometimes called prepaid debit cards, are issued by companies like American Express®, Visa®, Discover® and Mastercard®. Although a direct. To transfer money from your Direct Express card to a bank, call the Direct Express card toll free customer service department number on the back of your card. With a PayPal Prepaid Mastercard you can shop in store or online, wherever Debit Mastercard is accepted. Make PayPal Transfers from your account at PayPal to. The Postal Store will direct you to log into your PayPal™ account – simply There's no charge to sign up with PayPal™, send money, or buy items. You. Your federal benefits will be automatically deposited to your prepaid debit card account on the payment day. By choosing Direct Express® you have chosen a. Pay for your online money transfer securely. Send money instantly with a debit card with a debit card or credit card2, or with your bank account. How do I send money using PayPal? · Go to Send · Enter your recipient's name, PayPal username, email, or mobile number · Enter the amount, choose the currency, and. Send money to Visa/Mastercard debit cards via PayPal. Quick transfers in 30 mins, standard transfers in 48 hrs. Fees apply. Email confirmation required. Learn the quick & secure way to transfer funds from Direct Express to PayPal! Follow our easy steps to streamline your finances today. Log in to your PayPal Prepaid Card Online Account Center, click on the PayPal Transfers1 section, and follow the steps to transfer money from your PayPal. However, if you have a PayPal balance, you can use instant transfers to move your money to your bank or debit card up to 30 minutes for an extra fee. Maybe you. While PayPal may not directly support Direct Express, it could serve as a middleman. Users can link their Direct Express card to PayPal. You can use the following cards, including prepaid cards: Visa; Mastercard; Discover; American Express. Was this article helpful? Yes. No. Related topics. Xoom - Global Money Transfer · Help Center · Send Pay Bills Reload Learn more about the payment methods you can use with PayPal on PayPal's Help Center. Government Payments: Our Benefits Express service makes it easy to set up direct deposit of government payments like Social Security, SSI or SSDI payments. To link a card to PayPal, ensure no billing address issues, declined charges, too many linked cards or incorrect CSC codes. Contact PayPal or issuer for. Methods of payment accepted by PayPal are: PayPal balance, PayPal branded By Direct Deposit. Your child support payments can be deposited directly.